Hello Gnees Army,

Good Morning,

Before we jump over to the types of Insurance. Let’s know what is Insurance? In simple words, Insurance is nothing but protection from financial loss. It is a kind of risk management system, primarily used to protect against the risk of a sudden or uncertain loss.

An agency or organisation which provides insurance is known as an insurer or insurance company or insurance carrier or underwriter. A person who buys insurance is known as an insured or a policyholder. The insured receives a contract, called the insurance policy, which details the conditions and circumstances under which the insurer will/obliged to compensate the insured.

The amount of money charged by the insurer to the policyholder for the coverage declared in the insurance policy is called the premium. If the insured experiences a loss which is potentially covered by the insurance policy, the insured/policyholder can submit a claim to the insurer for compensation.

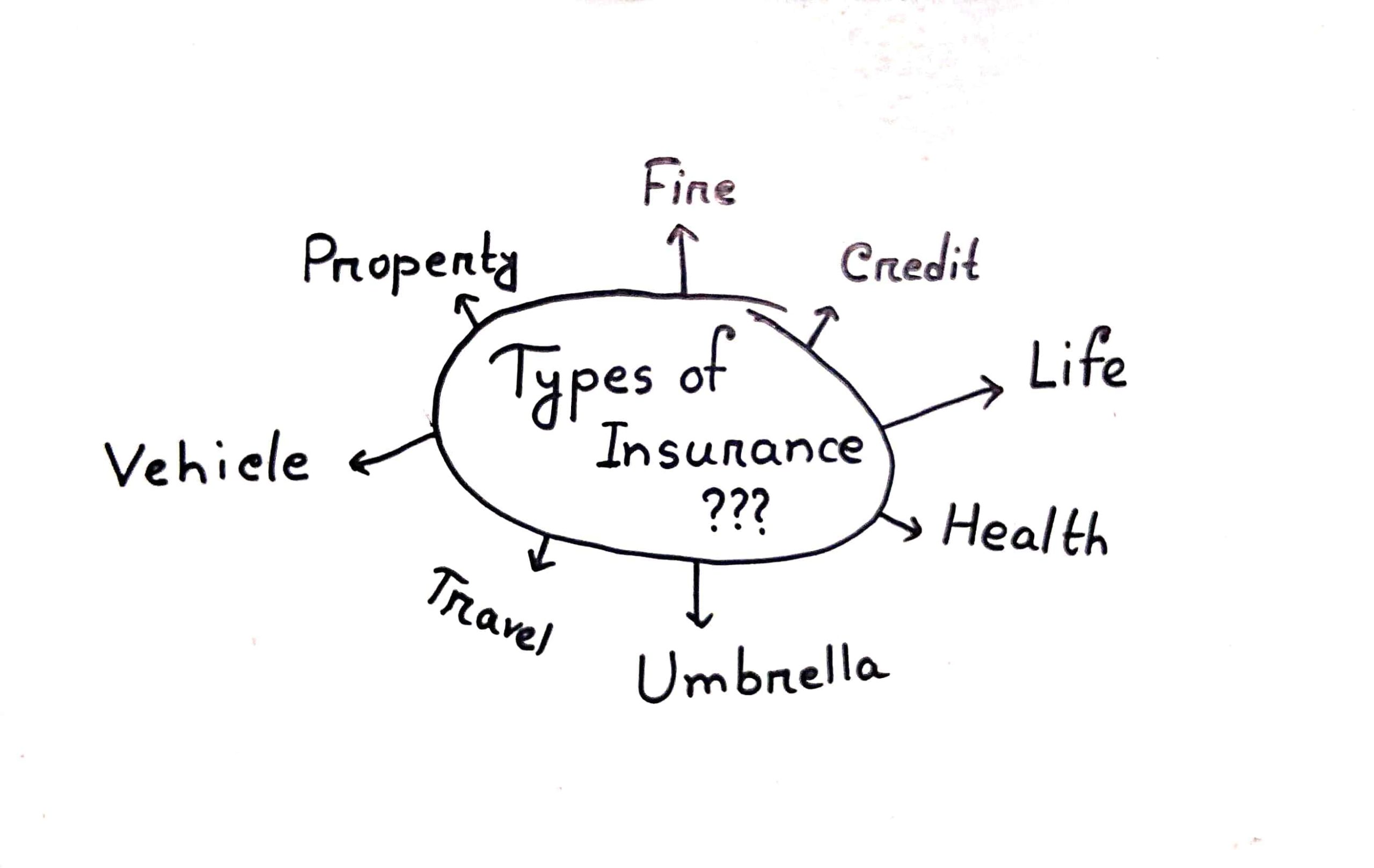

However, today we’re only discussing the types of insurance. Basically, Insurance is only two types – One is Life Insurance and Another is General Insurance. Except for Life Insurance, all other insurances are categorized in General Insurance. As there is no limit of types of General Insurance, there are thousands of insurances can be mentioned here. But as it’s not possible to discuss each and every insurance, in this article we’re only focusing on insurances that are widely popular or used across the world. So, Are you ready? Here we go …

Life Insurance

Life Insurance is different from other insurance in the sense that, here, the subject matter of the life of a human being. That’s why at present, life insurance enjoys a maximum advantage. In simple, Life insurance is a contract between one person and the issuer that offers financial compensation in case of death or disability of that person. Some life insurance policies even offer financial compensation after your retirement or expiry of a certain period of time (that is called Term in insurance).

Likewise, it helps you to secure your family’s financial security even in absence of you. You either make a huge payment while purchasing a whole life insurance policy (Whole Life Insurance) or make periodic instalments (Term Insurance) to the insurer. These are also known as premiums.

Highlights:

- Family support absence of you: In exchange of money, your insurer promises to pay a guaranteed amount to your family in the event of your death, disability, or at a set time.

- Surety: It’s important and gives surety to give an adequate amount at old age when our earning capacities are degraded.

- Tax-free experience: Life insurance also provides a little number of tax-free capabilities. Across the world, there are many countries, like the United States, India, UK, … the tax law provides that the interest on this, the cash value is not taxable under certain circumstances.

Thus, This benefits leads to the widespread use of life insurance as a tax-efficient method of saving as well as protection in the event of early death.

Health Insurance

Health insurance covers the cost of medical treatments of a person. It refers to a type of General Insurance and provides financial assistance to policyholders when they go for medical treatment. In most developed countries, all citizens receive some health coverage from their governments, paid through taxation. In Simple, this insurance compensates the amount you pay towards the treatment of any injury or illness.

Highlights:

- Maternity cover: The costs related to childbirth. This includes pre-delivery check-ups, hospitalisation during delivery, and post-natal care.

- Pre-existing diseases cover: Takes care of the treatment of diseases you may have before opting the insurance.

- Accident cover: Pay for the medical treatment of injuries caused due to accidents or disasters. Medical bills prior to or post hospitalisation.

- Cashless Claim – If you ask treatment at one of the hospitals which have tie-ups with your insurance provider, you can avail cashless claim benefit. This feature ensures that all medical bills are directly compensated between your insurer and hospital.

Types of Health Insurance policies

These are some basic types of health insurance policies that are popular across the world –

- Individual Health Insurance -This policy offers medical cover to just one policyholder or person.

- Family Insurance -It allows you to avail health insurance for your entire family not needing to buy separate plans for each member. Generally, husband, wife and their children are allowed health cover under the family insurance policy.

- Critical Illness Cover – This one is specialised for health plans that provide extensive financial assistance when the policyholder is diagnosed with specific, chronic illnesses. These plans provide a lump-sum payout after such a diagnosis.

- Senior Citizen Health Insurance – As the name suggests, these policies specifically for individuals aged 60 years or more.

- Group Health Insurance – This policy is generally offered to employees of an organisation or company.

- Maternity Health Insurance – These policies cover medical expenses during pre-natal, post-natal and delivery stages. It covers both the mother as well as her baby.

- Preventive Healthcare Plan – Such policies cover the cost of treatment to prevent a severe disease or condition.

Home/Property Insurance

You make your dream home after dedicating money, times and efforts for years. What will you feel when you see your property accidentally damaged by unwanted situations??? And those unwanted situations may be a certain specified risk like fire or marine hazards, theft of property or goods (burglary), machine break down, damage to property at the accident.

Rebuilding or renovation of a property is immensely expensive. Thus, property insurance policies enter here. It is the best option to ensure the long-term health of your property. Home insurance pays or compensates for such these types of damage to your home due to natural calamities, man-made disasters or other threats. Under the property insurance property of person/persons are insured against If any such damage occurs to your property, you can claim financial assistance from the insurance provider. This not only covers the financial protection to your home but also takes care of the valuables inside the property.

Highlights:

- Fire Protection -While the insurance policy can’t prevent fires, but can prevent financial losses from such an event.

- Burglaries/Thefts – If your property exists in an area prone to theft and burglaries, such a policy is vital to ensure your financial security.

- Natural Calamities – The plan also offers financial support against damage resulting from earthquakes, storms, flood etc.

Vehicle/Motor Insurance

Day by day cars and bikes are becoming increasingly expensive. At such a time, staying without proper insurance can lead to severe financial losses for the owner. Here comes the Motor or Vehicle insurance which refers to financial assistance in the event of accidents involving your car or bike. Motor insurance can be availed for these categories of motorised vehicles, including:

- Car Insurance – Personally owned four-wheeler vehicles are covered under such a policy.

- Two-wheeler Insurance – Personally owned two-wheeler vehicles, including bikes and scooters, are covered under these plans.

Highlights:

- Prevents Legal Hassle -Helps you avoid any traffic fines and other legalities that you would otherwise need to bear.

- Meets All Third-Party Liability – If you injure a person or damage someone’s property during an accident, the insurance policy helps you meet the monetary losses, effectively.

- Accidental Assitance after accidents – After accidents, you need to spend considerable amounts of money for repairing your own vehicle. This Insurance plan limits such out of expenses, allowing you to undertake repairs immediately.

- Theft/loss cover – If your vehicle is stolen, your insurance policy will help you reclaim a car/bike on-road price.

Travel Insurance

When we’re talking about the different types of insurance policies and travel insurance policy isn’t included, it’s weird. By the names, you already guess what it relates to. Yes, this policy/insurance is all about travelling and very useful when you’re travelling abroad or domestic. It ensures the financial safety of a traveller during a trip. Therefore, when compared to other insurance policies, travel insurance is a very short-term cover. However, there are basically two types of Travel Insurance:

- Single Trip Policy: It covers during a trip that lasts under 180 days.

- Annual Multi-Trip: It covers you for several trips you take within a year.

Depending on the insurance provider, travel insurance may offer financial aid at various times, such as during loss of baggage, flight delay, hijacking, accidental death, trip cancellation and much more. Varying travels travel insurance plans also a little bit different:

- Domestic Travel Insurance – This insurance policy safeguards your finances during travels within your country. If you plan to step outside of the country for a vacation, this policy would not offer any aid or maybe not valid.

- International Travel Insurance – If you are stepping out of the country, ensure you pick an international travel insurance plan. It allows you to cover the unexpected expenses that can arise during your trip like medical emergencies, baggage loss, loss of passport, etc.

Highlights:

- Flight Delay -Flight delays or trip cancellations can lead to significant losses for the passenger. If you buy travel insurance, you can claim such financial losses from the insurer.

- Baggage Loss/Delay -Travel insurance lets you claim financial assistance if there is a baggage delay in 24 hours or lose your luggage during the trip.

- Reclaim Lost Travel Documents -Visa and passport are essential documents during an international trip. Opting for international travel insurance ensures that you have the necessary financial backing to reapply for replacement documents when needed.

- Trip Cancellation – A sudden death in the family or such an emergency may cause your travel to cancel. Here in this insurance supports trip cancellations in such events. You can claim financial assistance to pay penalties and cancellation charges for flights, hotels, etc.

Umbrella insurance

Note that this insurance policy may only available in developed countries like USA, UK and can only be applied when you have an existing insurance policy already. You can think this as extra insurance protection for your insurance. For example, let’s say you get into a car crash. Your vehicle insurance will payout the whole. Now, let’s imagine in your car crash that car is a Lamborghini or BMW. Your insurance might not cover enough damage in that situation. Rather than paying out from your pocket, your umbrella insurance policy enter here and will save your pocket about thousands of dollars.

Highlights:

- Extra protection: It protects you when other insurance policies end by their limitation.

Other forms of Insurance

As there are tons of insurances, they are hard to classified in each category. So we are now discussing others forms insurances which are commonly used and popular across the world.

Marine Insurance

Marine insurance provides protection against the loss of marine hazards. The marine hazards/perils are collision with a rock or ship, attacks by enemies, fire, captured by pirates, destruction or disappearance of the ship etc. Previously only certain nominal risks were insured but now it has been divided into two parts; Ocean Marine Insurance and Inland Marine Insurance.

Fire Insurance

Fire Insurance covers the risk of fire. Though the unexpected fire can’t be controlled, it’s damage to valuables can be protected by this insurance! With the help of fire insurance, the losses arising due to fire are compensated by the insurer. The individual is preferred from such losses and his property or business or industry will remain approximately in the same position in which it was before the loss.

Credit Insurance

Credit insurance repays some or all of a loan when the borrower is bankrupt. Many credit cards offer payment protection plans which are a form of credit insurance.

Income Protection Insurance

Workers or employers compensation, liability insurance, is compulsory in some countries like the USA. Disability insurance policies provide financial support in the event of the policyholder becoming unable to work because of disability, illness or injury. Short-term and long-term disability policies are available to individuals, but considering the expense, long-term policies are generally obtained only by those with at least six-figure incomes like doctors, lawyers, etc.

Short-term disability insurance covers a person for a period typically up to six months, paying some financial each month to cover medical bills and other necessities. Long-term disability insurance covers an individual’s expenses for a long time until they are considered permanently disabled. Though that time, Insurance companies will often try to encourage the person back into employment before declaring them unable to work or totally disabled.

Liability Insurance

Liability insurance policy compensates for the damage for both you and your victims in an accident. For this, liability insurance is also called third-party insurance. In Simple, Liability insurance covers you if you are found liable for injury or damage/destruction of someone else or to their property. Liability insurance does not cover intentional or criminal acts when the insured or policyholder is found legally responsible. In addition, These Policies protect both the insured/policyholder and third parties who may be injured as a result of the policyholder’s unintentional carelessness. So it’s a win-win situation for society.

For example, in most countries, vehicle owners have to own liability insurance under their automotive/vehicle insurance policies to cover injury to other people and the damage of the property in the event of an accident. For another example, A product manufacturer, suppose Apple for iPhone, may purchase product liability insurance to cover them if a product is defective and causes damage to their buyers or another third party.

Other Insurances like Pet Insurance (Provides financial help to your pets such as cat, dog sickness), Social Insurance [Mass insurance program that provides protection against various economic risks (e.g., loss of income due to sickness, old age, or unemployment) and in which participation is compulsory] are also popular around the world.

What does insurance not cover?

Your policy may not cover liabilities in certain situations. These are some known situations that are not covered generally. This includes but not limited to –

Life Insurance

If the death happens due to:

- Alcohol or drug consumption

- War or terrorism

- Suicide or self-inflicted injuries

- Totally negligence or carelessness

Vehicle Insurance

- Damage due to war, revolution or nuclear risk

- General ageing

- Tire or tube punctures. (If however, your vehicle is damaged at the same time, you may be compensated for 50% of the cost of repair or replacement)

- Mechanical or Electrical breakdown

- Any loss or damage caused outside your country

- Damage caused when the policy is not active

- Loss of personal belongings kept in the vehicle (Especially for cars)

- Damage to a vehicle that is not insured

- Damage caused when driving without a license

Health Insurance

- Hospitalisation due to war or related activities

- Medical condition due to abuse of intoxicants or hallucinogenic substances

- Any medical condition exists before buying the policy

- Non-allopathic therapies such as acupuncture, yoga, naturotherapy, etc.

- Diagnostic charges if the reports do not confirm the existence of the covered disease

- Self-inflicted injuries

Travel Insurance

- Travelling against the advice of the physician

- Baggage delay for less than 24 hours

- Psychological illness or self-inflicted injuries during your trip

- War or civil disturbance in international locations

- Participation in hazardous sports like bungee jumping, parachuting, etc.

Home/Property Insurance

- Intentional destruction of your property by yourself

- Damages caused due to wear and tear

- Loss of money kept inside the property

- A loss to a property that has remained unoccupied for a certain period

Hope you now have a little bit clear conception about types of insurance. Thanks for reading. See you soon 😉

[Note: Information provided above is only for having the basic knowledge of types of insurances and their general terms. Don’t take this info too seriously because some of them may differ/vary from country to country, time to time or even company to company. So, applying for such insurances, read the official documents of terms and conditions of respective insurer carefully.]

Read Also:

- What is pneumonoultramicroscopicsilicovolcanoconiosis?

- Fluoroantimonic Acid – Strongest Acid in the World Ever!

- Painite – The Rarest Gem on Earth! | Price $50k/0.2 gram

- Paedophryne Amanuensis – Meet the smallest frog in the world!

- Pirates of the Caribbean: On Stranger Tides – Most Expensive Film Ever!